give

Join us today in the fight against hunger, homelessness and access to healthcare in our community.

your generosity at work

$90

Provides three weeks of supplementary food for a family.

$260

Shelters a woman for one week (5 days) at our Helen Wright Center.

$360

Purchases 46 prescriptions.

$600

Feeds 20 families for a week.

$1,160

Provides a year of comprehensive care for a clinic patient.

smart giving

Stock Donation

- Donations of stocks or bonds are a tax-effective way to support Urban Ministries of Wake County.

- If you would like to make a stock transfer, please click here to fill out our form. It helps ensure we track your donation and are able to send a tax acknowledgment letter.

Qualified Charitable Distribution

- Donate from your IRA:

- Individuals 70 1/2 years old or older can donate up to $100,000 directly from an IRA to a qualified charity.

- The donated amount is not included in your taxable income.

- By making a QCD, you satisfy your RMD requirement while supporting a charitable cause without incurring additional taxes.

Matching Gifts

- DOUBLE the impact of your donation. See if your employer matches your gift by clicking here!

planned gifts

Leaving a Legacy with Urban Ministries of Wake County

Provide tax benefits for you and your heirs, while helping our neighbors in need! For information on Planned Giving, choose from one of the following options:

Retirement Assets

Donating part or all of your unused retirement assets, such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan, is an excellent way to make a gift to UMWC.

To leave your retirement assets to UMWC, you will need to complete a beneficiary designation form provided by your retirement plan custodian.

Benefits of retirement assets:

- Avoid potential estate tax on retirement assets

- Heirs avoid income tax on any retirement assets funded on a pre-tax basis

- Receive potential estate tax savings from an estate tax deduction

Charitable Bequest

With the help of an attorney, you can include language in your will or trust specifying a gift to be made to UMWC as part of your estate plan, or you can make a bequest using a beneficiary designation form.

Benefits of a bequest:

- Receive an estate tax charitable deduction

- Reduce the burden of taxes on your family

- Leave a lasting legacy to UMWC

Real Estate

Donating appreciated real estate, such as a home, vacation property, undeveloped land, farmland or commercial property, can make a great gift to UMWC.

Your real property may be given to UMWC by executing a deed transferring ownership. Your gift will generally be based on the property’s fair market value, which must be established by an independent appraisal.

Benefits of gifts of real estate:

- Avoid paying capital gains tax on the sale of the real estate

- Receive a charitable income tax deduction based on the value of the gift

- Leave a lasting legacy to UMWC

honoring friends and family

make your gift even more meaningful

Urban Ministries can help you memorialize, honor and celebrate friends & family. When you make a donation via the form above, be sure to include the name of your honoree and their email address in the “additional information” field. We’ll send an e-card in your name stating your gift has been given.

Have questions about Honor Cards? Send us an email!

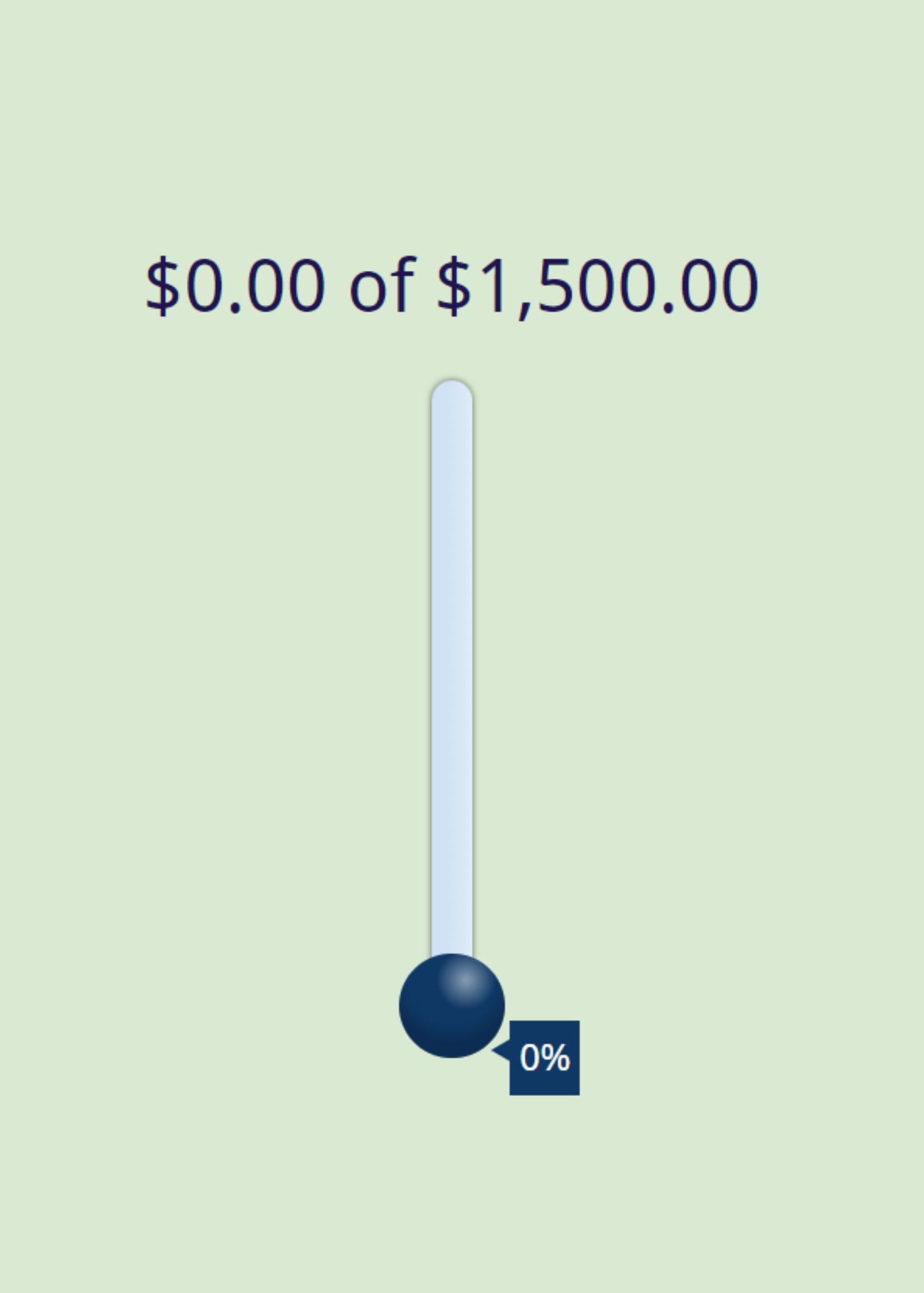

host a virtual fund drive

leverage your influence

Share the link to a personal page to raise money for food to stock our pantry, items for our clinic, or to support the Helen Wright Center for Women. As people click on your link and donate, money is credited towards the fund drive. Watch in real-time how much your drive is raising.

Email us to set up your drive today.

Mail your checks to:

Urban Ministries of Wake County c/o Development

1390 Capital Blvd, Raleigh, NC 27603

Questions? Call 919-836-1642 ext. 100

Urban Ministries of Wake County respects the privacy of our donors and does not share donor lists with third parties.

Triangle United Way Number: 840 | Combined Federal Campaign Code: 28226 | State Employees Combined Campaign Code: 2573

Tax ID No. 58-1422700